At the moment, the market does not offer tools for insurance against the risks of sudden price fluctuations. Although there are futures and options on centralized exchanges, there are more minuses than pluses in this. As an example, you can bring a high cost of options or a guarantee for futures at the level of 80-100%. The reason for this is the impossibility of insuring the risks of sellers, which leads to a high cost option for buyers.

We offer a new revolutionary solution for crypto-currency markets, where sellers are not necessary - a reverse bet.

Benefits

Transparency

All trade transactions are made through smart contracts that guarantee payments to all the winners and provide monitoring of the pool.

Guarantees

The APO platform does not require the participation of option sellers - buyers pay for the option directly to the pool, eliminating the risk of unfulfilled obligations.

Decentralization

The system being developed is based on clever contracts in the detachment, which stores all information about transactions.

Dividends

The platform does not participate in the trade as an organizer, but requires a fee for its provision, part of which will be distributed among the holders of the tokens.

Insurance

The APO lacks guarantee fees - an ideal tool for both miners and investors, protecting against a falling market.

Flexibility

Each participant can create their own option - from binary to exotic (at their own discretion) or use standard ones.

Spreads

On the APO platform, there are no spreads between supply and demand, because there are no sellers who can raise the price to reduce risks.

How it works

Auction

The auction date is set one week before the expiration. The frequency and duration of auctions will be determined during the beta test.

The platform plans to use standard expiration terms for options:

2 weeks

1 month

3 months

Based on this, the frequency of auctions will depend on the closest expiration of the contract.

The main objective of the auction is the calculation of bonuses and payments based on confirmed applications. Each participant creates the desired option or selects the desired one from the templates and introduces the strike-price for a certain currency (BTC or ETH). After that, the participant chooses the type of order - market or limit and transfers the necessary amount of money to buy the option to the account of a smart contract.

Bargaining

The pool is formed when the auction has come to an end and all claims are counted. After the transaction, each participant can log into his account through a website or mobile application and see the accrued options, as well as monitor their price until expiration.

Expiration

The option execution date is formed in advance at the auction, for example, at 12 noon on January 12, 2018. At the time of expiration, the price of the asset is fixed (the price is determined by data from several large exchanges). On the basis of this price payments are made to the owners of options. After expiration, each participant can check his account.

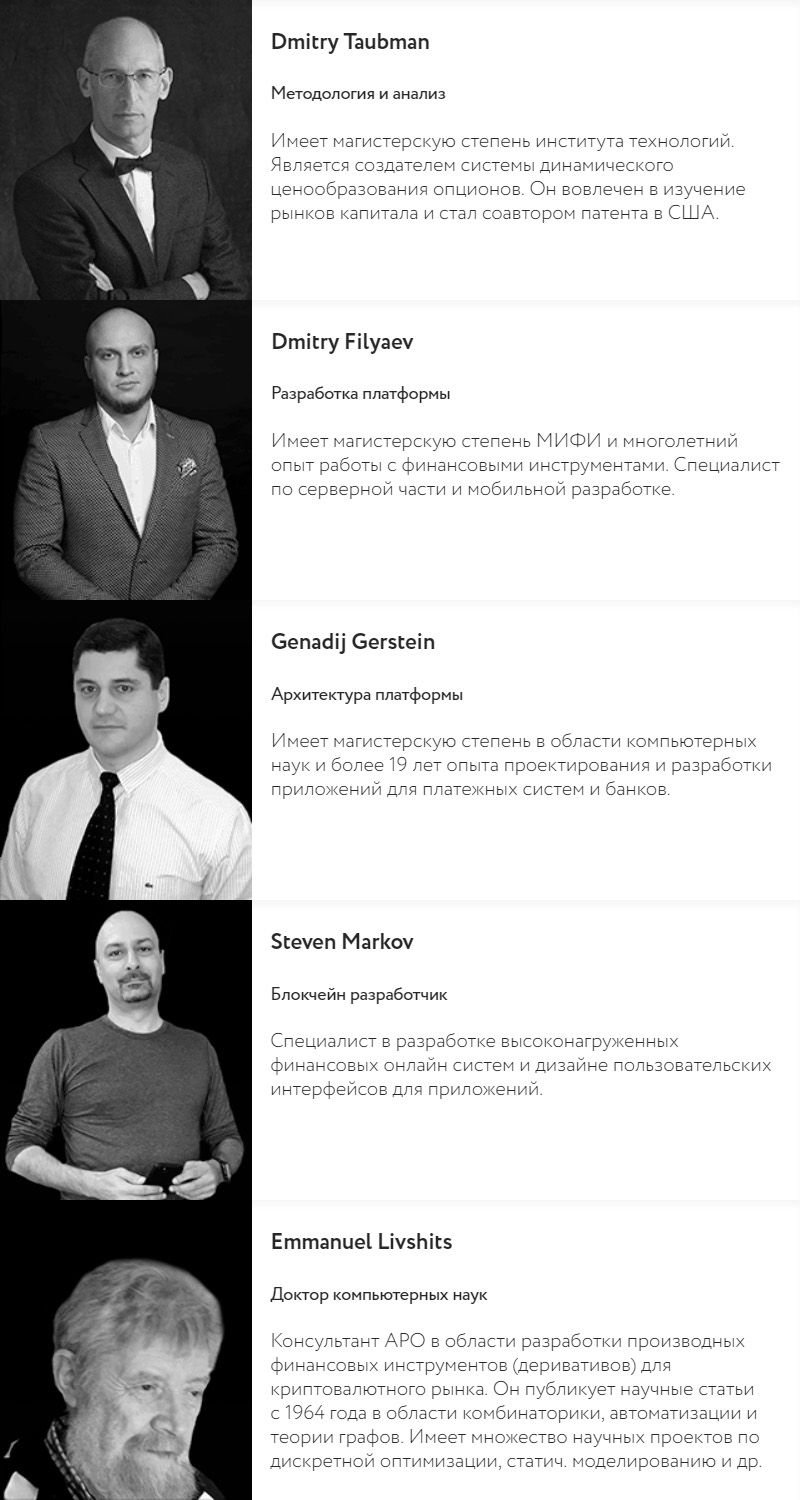

TEAM

FOR MORE INFORMATION CLICK ON LINKS BELOW:

Website: https://apofinance.io/

Telegram Group: https://t.me/apofinancegroup

Telegram Channel: https://t.me/apofinance

Whitepaper: https://apofinance.io/files/whitepaper.pdf

Medium: https://medium.com/@apofinance

AUTHOR:Persijadays

Tidak ada komentar:

Posting Komentar